tax loss harvesting wash sale

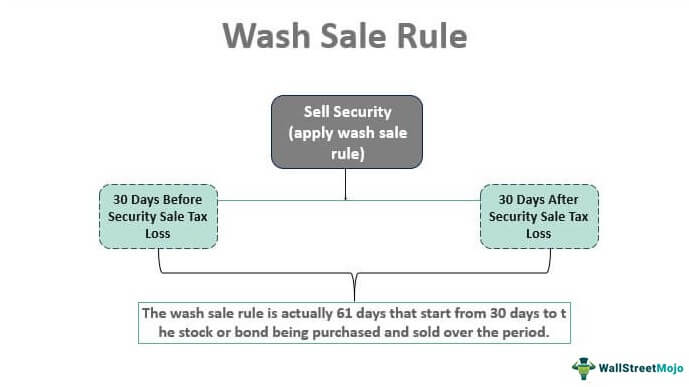

A wash sale occurs when a taxpayer harvests losses on a stock or security but purchases the same one or a substantially identical one within the 30 days before or after the sale. Federal government allows investors to use capital losses to offset capital gains in a current tax year or carry the loss.

Year End Financial To Do Considering The Tax Loss Harvesting Strategy Benjamin F Edwards

You plan to use that loss to shelter an equal amount of 2021 capital gains.

. The basic concept of the wash-sale rule is relatively straightforward its purpose is to limit someone from Tax Loss Harvesting TLH by just selling an investment for a tax loss and immediately buying it back again which could otherwise result in tax savings in the form of a deductible loss without the investor substantively changing hisher economic position at the. First if the long term investor mentioned above who has no realized gains wants to harvest losses to reduce their taxable income they can only do so. Mary can use the 7000 capital loss to.

A wash sale involving an IRA401 k account is particularly unfavorable. Assuming that I had no other capital gains or losses for the year I could use my loss to offset my entire gain from Security. That is the investor cannot sell an asset at a loss and buy a substantially identical asset.

In order to make use of tax-loss harvesting the investor cannot violate the IRS wash sale rule. Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to harvest losses for tax purposes. Generally a washed loss is postponed until the replacement is sold but if the replacement is purchased in an IRA401 k account the loss is permanently disallowed.

The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their ordinary income. You thought you could harvest a tax-saving 8000 capital loss by selling the shares on December 15 2021 for 12000 20000 basis minus 12000 sales proceeds equals 8000 loss. If not managed correctly wash sales can undermine tax loss harvesting.

Up to 3000 of losses each year can be taken as a deduction. And Mary would use the proceeds from the sale to purchase another fund to serve as a replacement in her portfolio. Sadly the wash sale rule disallows your anticipated 8000 capital loss deduction.

Instead the disallowed loss increases the tax basis of the substantially identical securities. The wash-sale rule is a regulation established by the Internal Revenue Service IRS in order to prevent taxpayers from being able to claim. Wash sale rules dont prevent crypto tax loss harvesting entirely.

TLDR This thing sucks. The IRS will disallow the deduction of these losses. Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income.

If youre planning to sell stocksmutual funds at a loss to offset realized capital gains during the year its important to be aware of the wash sale rule. For example imagine you purchased an Ethereum position for 10000 and you held the. The value of the stock plummets.

Unfortunately there are some limits and rules to abide by. To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss. But in this scenario Fund B lost 33000.

How the rule works Under this rule if you sell stock or securities for a loss and buy substantially identical stock or securities back within the 30-day period before or after the sale date the loss CANNOT be. There are more options when applying a tax-loss harvesting strategy since the wash sale rule doesnt apply. You can - and should - still track your unrealized losses and regularly look for opportunities to harvest capital losses.

This is a lot easier with a portfolio tracker. Its important to note that you cannot get around the wash-sale rule by selling an. Tax loss harvesting overview.

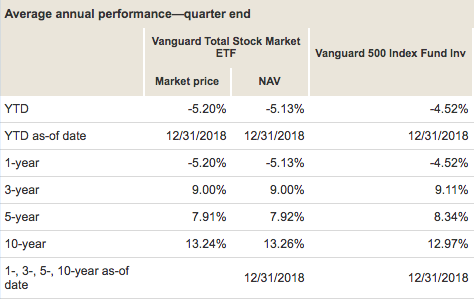

800 767-8040 Free Consultations Nationwide. Whenever you have significant losses in a taxable account you should consider tax loss harvesting selling those losses as a part of tax planning and then buying a placeholder security for 30 days. For example investors looking to tax-loss harvest cannot sell the Vanguard Intermediate-Term Treasury ETF VGIT and immediately repurchase it within 31 days.

Otherwise investors risk running afoul of the wash sale rule and no longer qualify for a tax deduction. Wash sale rule considerations. Therefore the tax basis of the Beta shares you acquire on December 19 2021 increases to 20200 12200 cost plus 8000 disallowed wash sale loss.

The asset sold is then replaced with a similar asset to maintain the portfolios asset allocation and expected risk and return levels IRS Wash Sale Rule. Tax Loss Harvesting and Wash Sale Rules. If an investment is not expected to perform well or to decline in the future then that investment is usually sold to prevent or mitigate losses or to invest in better opportunities.

They can also offset up to 3000 of ordinary income each taxable year. More specifically the wash-sale rule states that the tax loss will be disallowed if you buy the same security a contract or option to buy the security or a substantially identical security within 30 days before or after the date you sold the loss-generating investment its a 61-day window. The wash-sale rule stops investors from selling at a loss and buying the same time within a 61-day window as part of tax loss harvesting.

The disallowed loss increases the tax basis of the substantially identical securities -- the Beta shares you acquire on 122121 -- to 20200 12200 cost. To claim a loss for tax purposes. Lets say I still realized a profit of 30000 from Fund A.

However some investments are sold as part of a tax strategy to lower taxes especially at the end of the tax year. So far tax loss harvesting sounds like a great way to reduce ones tax liability. With tax-loss harvesting an investment that has an unrealized loss is sold allowing a credit against any realized gains that occurred in the portfolio.

Capital losses can offset capital gains or can give you a capital loss which you can report on your tax return. Tax Loss Harvesting Limits Rules and Wash Sales. Investors can offset up to 3000 per year and losses can be kept in perpetuity.

Your losses dont just offset your gains.

Year Round Tax Loss Harvesting Benefits Onebite

Tax Loss Harvesting Flowchart Bogleheads Org

What Is Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting Beyond The Basics Tax Minimization Strategy

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting And Wash Sale Rules

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting And Wash Sales Seeking Alpha

Tax Loss Harvesting Napkin Finance

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Wash Sale Rule Definition Example How It Works

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

Tax Loss Harvesting Definition Example How It Works